COVID-19 & Its Impact on Everyday Life: June 5-8, 2020

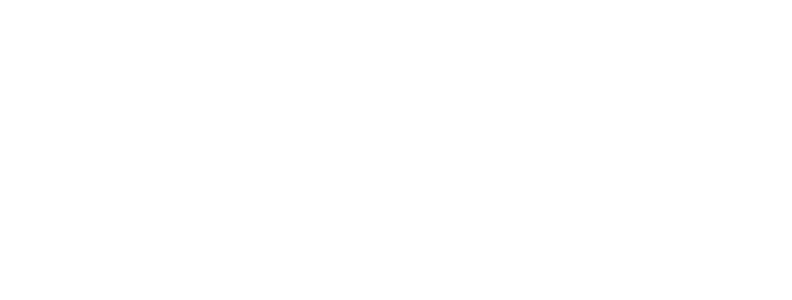

For the first time, a majority of Americans now believe the pandemic’s trajectory is positive. This hasn’t resulted in less concern. 85% of Americans continue to be concerned about the pandemic.

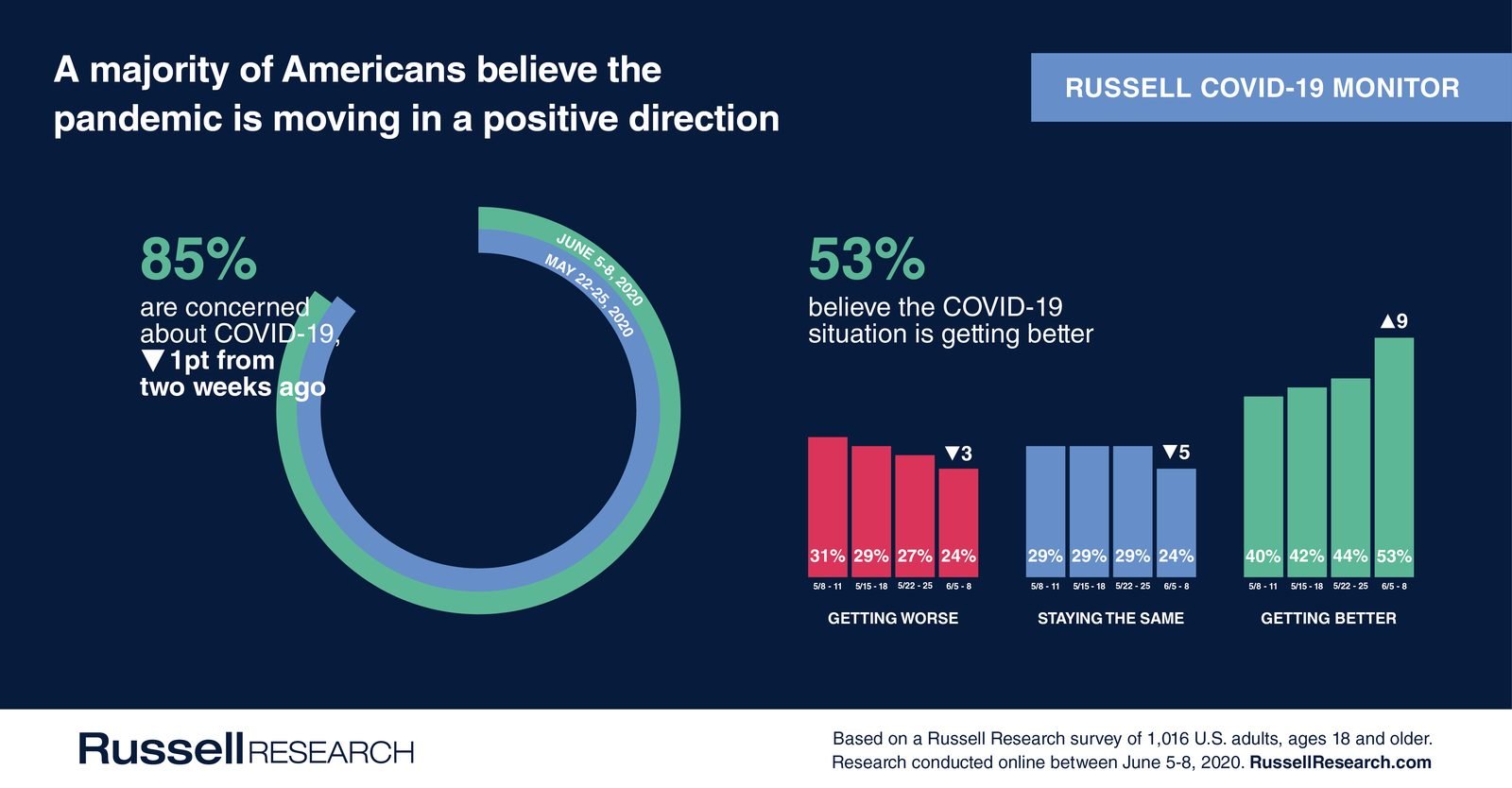

Over the next few weeks most types of businesses will have re-opened to some degree – whether it be restricted to outdoor dining, reduced indoor capacity, or forced distancing and health screening measures.

The vast majority of grocery shoppers are now willing to shop in-person, with most other destinations for essential items also experiencing increases in visitation intent versus two weeks ago.

Conversely, most Americans are not ready to visit non-essential businesses. However there are a few exceptions. Fast food represents the only dining category where there was significant positive movement in the past two weeks. Nearly one-half of category users are willing to physically enter one of these restaurants.

While Americans are generally not ready to return to specialty retail, two types of businesses realized significant positive gains in visitation intent over the past two weeks – home improvement and auto parts stores. These are likely shoppers who are now ready to address home or vehicle issues or projects which had been delayed due to COVID-19.

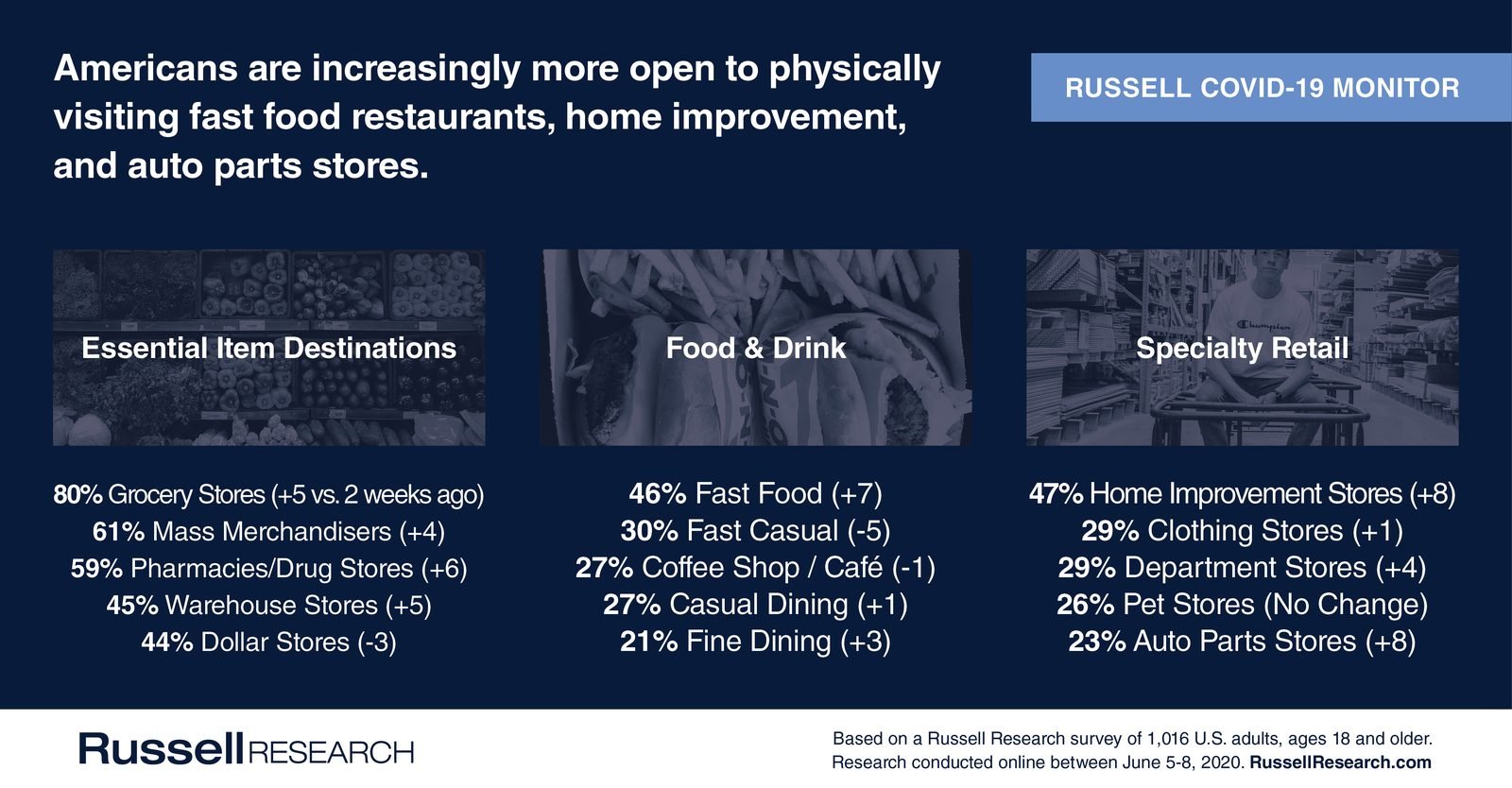

Signals of long-term behavior change remain in place. There has been no decrease in the percentage of Americans who plan to shop online more after the pandemic while shopping at malls less, exercise at home and not go the gym, and stream movies at home versus going to the theatre.

Russell Research has interviewed over 13,000 Americans over the past 3 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes. The study currently field every other week with the next wave slated for June 19-22, 2020.

Below are our key findings from June 5-8, 2020. Russell Research has tabulated data available for all 13,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

Concern about COVID-19 remains prevalent across the country. Between June 5-8, 85% of Americans indicated they are concerned about coronavirus, compared to 86% from two weeks prior.

A majority of Americans now believe the trajectory of COVID-19 is positive. 53% of Americans feel that the current situation is getting better, compared to 44% two weeks ago. 24% believe the situation is getting worse, compared to 27% two weeks ago.

Reopening America

There have been significant shifts in the percentage of category shoppers who will physically enter and shop at numerous essential item destinations.

Essential Item Destinations

- 80% of grocery shoppers intend to shop at a grocery store in the next month (+5 percentage points vs. two weeks ago)

- 61% of category shoppers intend to shop at a mass merchandiser in the next month (+4)

- 59% of category shoppers intend to shop at a pharmacy or drug store in the next month (+6)

- 45% of category shoppers intend to shop at a dollar store in the next month (+5)

- 44% of category shoppers intend to shop at a warehouse store in the next month (-3)

Fast food is the lone dining category that more Americans are comfortable entering when compared to two weeks ago.

Food & Drink

- 46% of category users intend to dine at a fast food restaurant in the next month (+7)

- 30% of category users intend to dine at a fast casual restaurant in the next month (-5)

- 27% of category users intend to go to a coffee shop or café in the next month (-1)

- 27% of category users intend to dine at a casual dining restaurant in the next month (-1)

- 21% of category users intend to dine at a fine dining restaurant in the next month (+3)

There have been significant increases for in-person shopping intent at home improvement and auto parts stores – likely due to consumers now being ready to address delayed purchases for their homes/vehicles.

Clothing & Specialty Retail

- 47% of category shoppers intend to shop at a home improvement store in the next month (+8)

- 29% of category shoppers intend to shop at a clothing store in the next month (+1)

- 29% of category shoppers intend to shop at a department store in the next month (+4)

- 26% of category shoppers intend to shop at a pet store in the next month (no change)

- 23% of category shoppers intend to shop at an auto parts store in the next month (+8)

- 22% of category shoppers intend to shop at an electronics store in the next month (no change)

- 20% of category shoppers intend to shop at a shoe store in the next month (+1)

- 19% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (-3)

- 18% of category shoppers intend to shop at a home goods store in the next month (-2)

Long-Term Behavior Change

Perceived long-term behavior change (post-pandemic) continues to hold strong in certain areas. There have been virtually no changes over the past 12 weeks in the percentage who report they will continue to maintain current changes.

More Likely To Do In The Long-Term Vs. Before COVID-19

- 37% of Americans indicate that they will be more likely to shop online post-coronavirus in comparison to before the pandemic (34% – 39% over the past 12 weeks)

- 28% will be more likely to stream TV shows or movies in comparison to before the pandemic (26% – 34% over the past 12 weeks)

- 30% will be more likely to exercise at home in comparison to before the pandemic (26% – 32% over the past 12 weeks)

- 19% will be more likely to order takeout or delivery in comparison to before the pandemic (17% – 22% over the past 12 weeks)

- 14% will be more likely to have groceries delivered in comparison to before the pandemic (10% – 14% over the past 12 weeks)

Less Likely To Do In The Long-Term Vs. Before COVID-19

- 36% of Americans indicate they will be less likely to go to the movies post-coronavirus in comparison to before the pandemic (26% – 39% over the past 12 weeks)

- 30% will be less likely to go to the gym post-coronavirus in comparison to before the pandemic (24% – 31% over the past 12 weeks)

- 28% will be less likely to shop at a mall post-coronavirus in comparison to before the pandemic (26% – 35% over the past 12 weeks)

Travel

A majority of Americans continue to avoid major travel and shared transportation options.

- 64% of Americans are currently less likely to fly on an airplane (+2 percentage points vs. 2 weeks ago)

- 58% are currently less likely to use public transportation (+3)

- 54% are currently less likely to stay at a hotel (+2)

- 47%% are currently less likely to use ride-sharing services (+2)

- 34% are currently less likely to rent a car (-2)