COVID-19 & Its Impact on Everyday Life: August 14-17, 2020

The roller coaster ride continues. After a second spike where the pandemic was viewed as getting worse, there was positive movement in the perceived trajectory over the past two weeks.

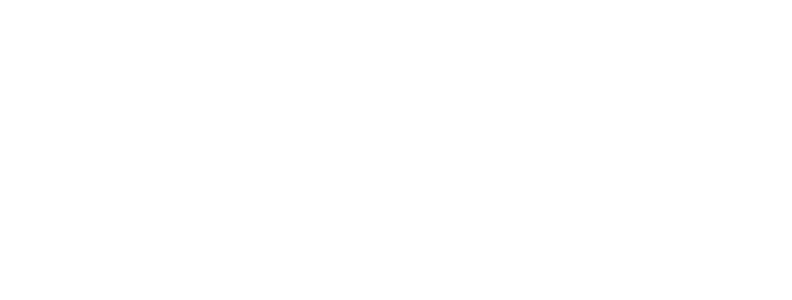

The Russell COVID-19 Monitor finds 48% of Americans think the pandemic is getting worse. This is a sharp decline when compared to the 60% who held this belief two weeks ago. However it remains the predominant feeling in the country. 30% of Americans believe the pandemic is improving, compared to 19% who held this opinion two weeks ago.

Concern has been a constant during the pandemic. 86% of Americans are currently concerned about COVID-19, in line with findings over the past three months.

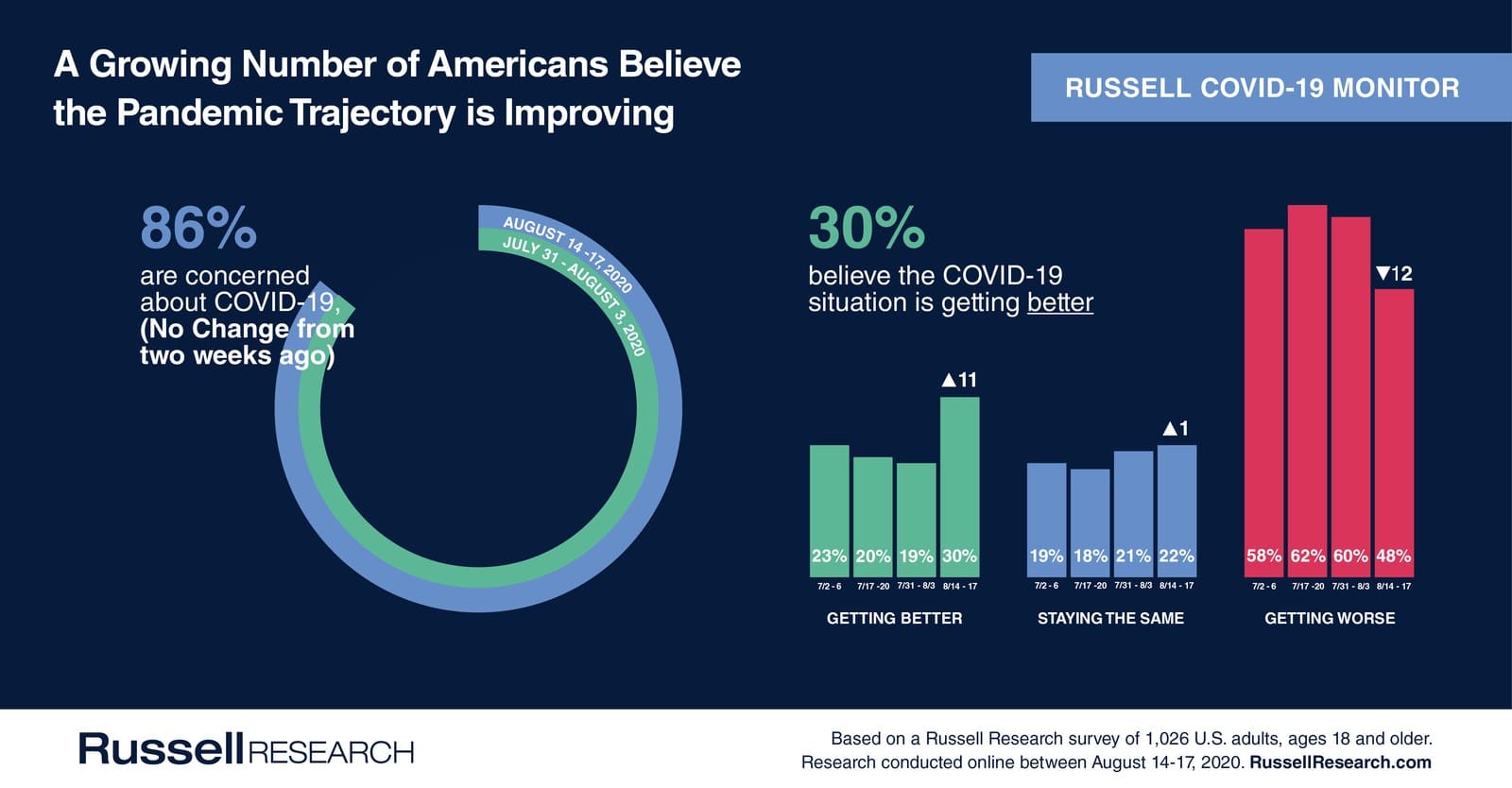

We had a special focus on remote learning this wave. It will be the primary form of instruction this fall, with 82% of parents indicating their children in grades K-12 will start the school year remotely. This will create shifts in back-to-school spending, as there will be less of a focus on traditional school supplies and clothing.

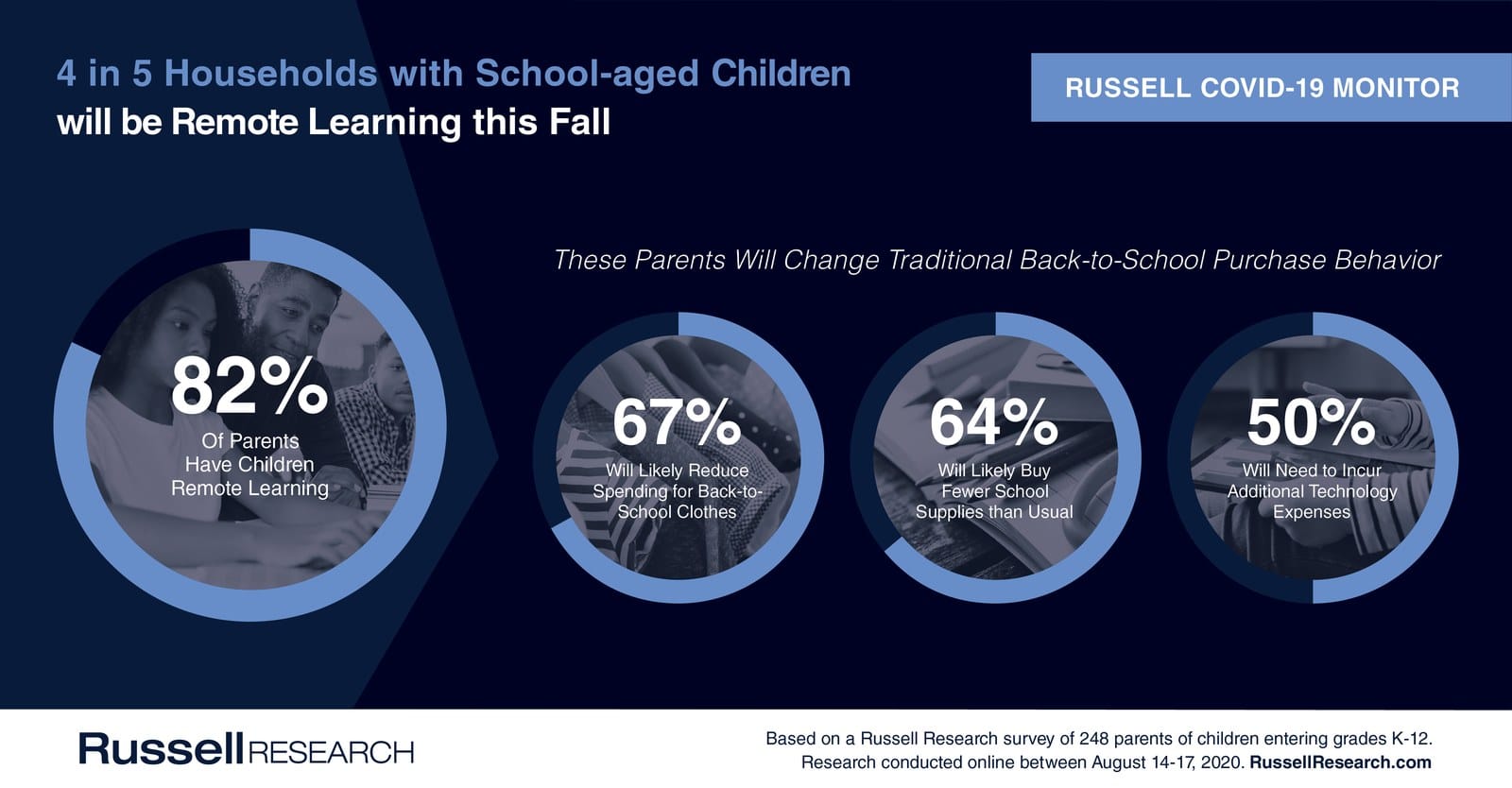

Meanwhile, there are technology, space, and attention gaps in many households which will need to be addressed by parents. It is no surprise there was a significant increase in the percentage of parents who report feeling overwhelmed over the past week.

There are a number of questions raised by the current situation which may create brand opportunities:

- How should retailers shift their product mix to address the needs associated with virtual learning and working from home?

- Is there an easy solution to address work productivity among parents?

- Can technology accommodate parents and children this fall or is there a better solution?

- How might we replace the lost socialization for children which is traditionally incorporated into the school day, along with subjects such as physical fitness, music, and the arts?

There were no major behavioral changes seen this week. Consumers will be utilizing a combination of pre-pandemic and new behaviors to purchase products for the foreseeable future.

Russell Research has interviewed over 18,000 Americans over the past 5 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will continue to evolve in the coming weeks as the situation changes. The study currently fields every other week with the next wave slated for August 28 – 31, 2020.

Below are our key findings from August 14 – 17, 2020. Russell Research has tabulated data available for all 18,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

Concern with COVID-19 remains highly elevated. Between August 14-17, 86% of Americans indicated they are concerned about coronavirus, unchanged from two weeks earlier.

There has been positive movement in the perceived trajectory of COVID-19. 48% of Americans now believe the situation is getting worse, compared to 60% two weeks ago.

30% of Americans feel that the current situation is getting better, compared to 19% two weeks ago.

The Impact of Virtual Learning

Most parents will have children remote learning at the beginning of the school year. This will cause a shift traditional back-to-school spending.

- 82% of parents with school-aged children indicate one or more of their children will be remote learning at the start of the school year.

- 67% of parents with children who are remote learning will likely reduce spending for back to school clothes

- 64% will likely buy fewer school supplies than usual

- 50% will need to incur additional expenses for the technology required at home for their children

- From an emotional standpoint, 34% of all parents felt overwhelmed in past week. This represents an 11-percentage point increase compared to 2 weeks ago and is the highest percentage for this emotion since early April.

Remote learning will impact employed parents from both a productivity and financial perspective.

- 47% of employed parents with children who are remote learning indicate having children at home during the day will lower their productivity at work

- 46% indicate it will force them to miss time at work

- 44% will need to pay someone to help their children during the day

Impact on Behavior

There were no major changes for next month in-person shopping intent at essential item destinations.

Essential Item Destinations

- 79% of grocery shoppers intend to shop at a grocery store in the next month (-4 percentage points vs. two weeks ago)

- 61% of category shoppers intend to shop at a mass merchandiser in the next month (+2)

- 58% of category shoppers intend to shop at a pharmacy or drug store in the next month (+1)

- 48% of category shoppers intend to shop at a dollar store in the next month (+2)

- 44% of category shoppers intend to shop at a warehouse store in the next month (-2)

Fast food remains to restaurant format with the most widespread consideration. There continues to be less than half of category users willing to dine at any individual format.

Food & Drink

- 43% of category users intend to dine at a fast food restaurant in the next month (no change vs. two weeks ago)

- 34% of category users intend to dine at a fast casual restaurant in the next month (-1)

- 29% of category users intend to go to a coffee shop or café in the next month (-3)

- 28% of category users intend to dine at a casual dining restaurant in the next month (+2)

- 19% of category users intend to dine at a fine dining restaurant in the next month (-1)

There was positive movement in shopping intent at apparel-focused retailers – clothing, department, and shoe stores.

Clothing & Specialty Retail

- 43% of category shoppers intend to shop at a home improvement store in the next month (-3 percentage points vs. two weeks ago)

- 35% of category shoppers intend to shop at a clothing store in the next month (+4)

- 33% of category shoppers intend to shop at a department store in the next month (+4)

- 31% of category shoppers intend to shop at a pet store in the next month (-1)

- 28% of category shoppers intend to shop at an auto parts store in the next month (+3)

- 27% of category shoppers intend to shop at a shoe store in the next month (+5)

- 24% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (-1)

- 24% of category shoppers intend to shop at an electronics store in the next month (no change)

- 23% of category shoppers intend to shop at a home goods store in the next month (+1)