COVID-19 & Its Impact on Everyday Life: July 31-August 3, 2020

The country appears to be past the initial shock of the resurgence of COVID-19 cases and its impact on consumer behavior. After several weeks of Americans increasingly feeling the pandemic trajectory is getting worse, this metric has now stabilized – albeit a negative consensus.

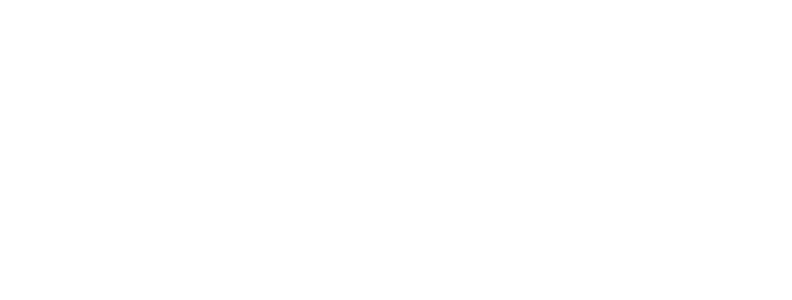

The Russell COVID-19 Monitor finds 60% of Americans believe the pandemic is getting worse versus 19% who view the pandemic as improving. This is nearly equal to our findings from two weeks ago (62% worse / 20% better). 86% of Americans are concerned about COVID-19, in line with findings over the past two months.

With this acceptance in place, there was a minor positive shift across many behavioral metrics this wave, reversing the decline in consideration of physical shopping and dining seen in recent weeks. This leaves retailers and marketers in an “in between” place. Consumers will be utilizing a combination of pre-pandemic and new behaviors to purchase products for the foreseeable future.

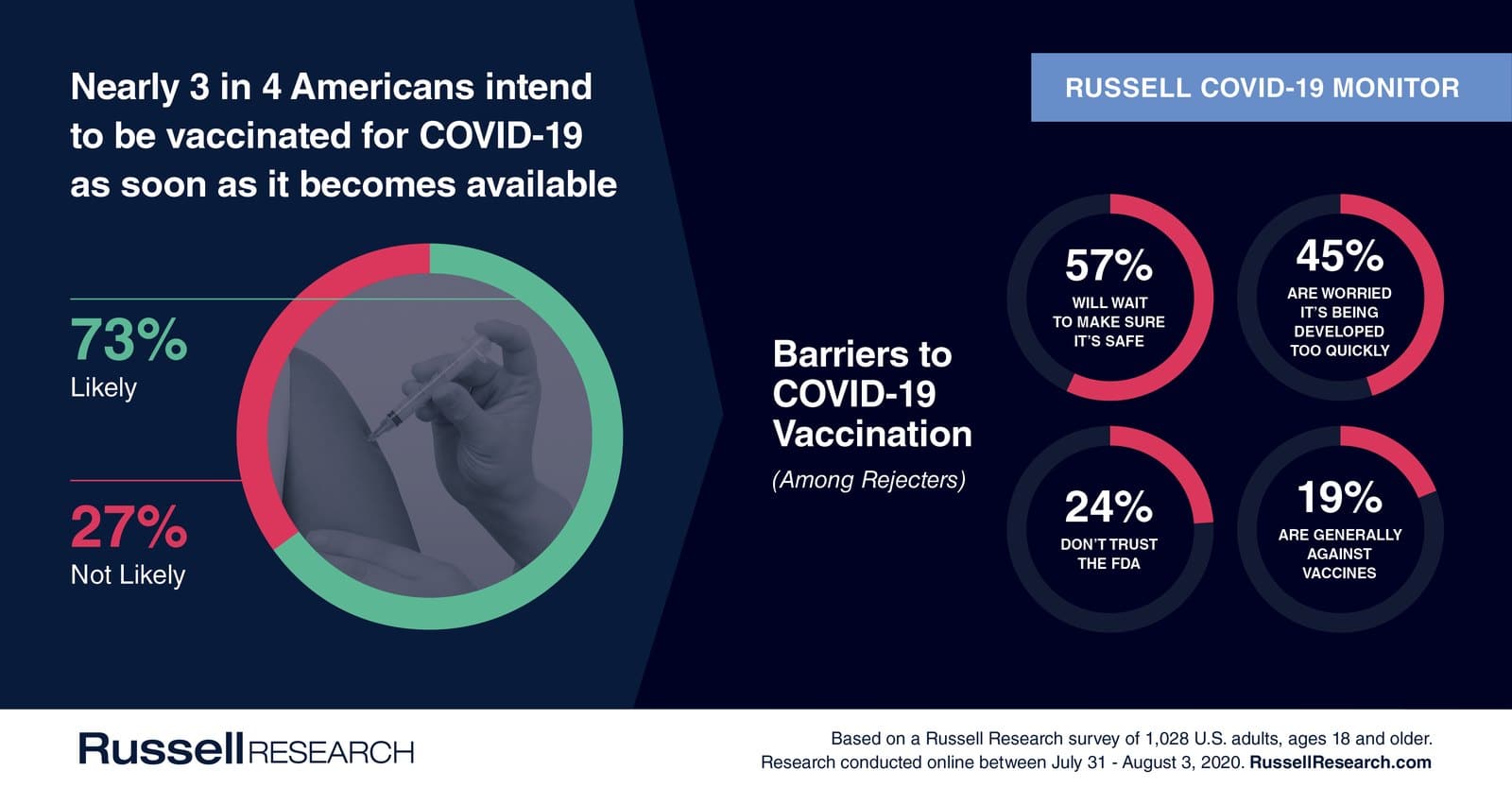

We asked Americans about a COVID-19 vaccine in this week’s study. This is the endgame for many consumers who do not foresee fully returning to everyday life until a vaccine is available.

The primary barrier to vaccination is safety concerns. Vaccine rejecters want to first ensure it is safe before being vaccinated themselves. Nearly three in four Americans are very or somewhat likely to be vaccinated as soon as it becomes available.

Russell Research has interviewed over 17,000 Americans over the past 5 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will continue to evolve in the coming weeks as the situation changes. The study currently fields every other week with the next wave slated for August 14 – 17, 2020.

Below are our key findings from July 31 – August 3, 2020. Russell Research has tabulated data available for all 17,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

Concern with COVID-19 remains universal. Between July 31-August 3, 86% of Americans indicated they are concerned about coronavirus, compared to 87% two weeks earlier.

The perceived trajectory of COVID-19 remains negative though has stabilized. 60% of Americans now believe the situation is getting worse, compared to 62% two weeks ago.

19% of Americans feel that the current situation is getting better, compared to 20% two weeks ago.

Impact on Behavior

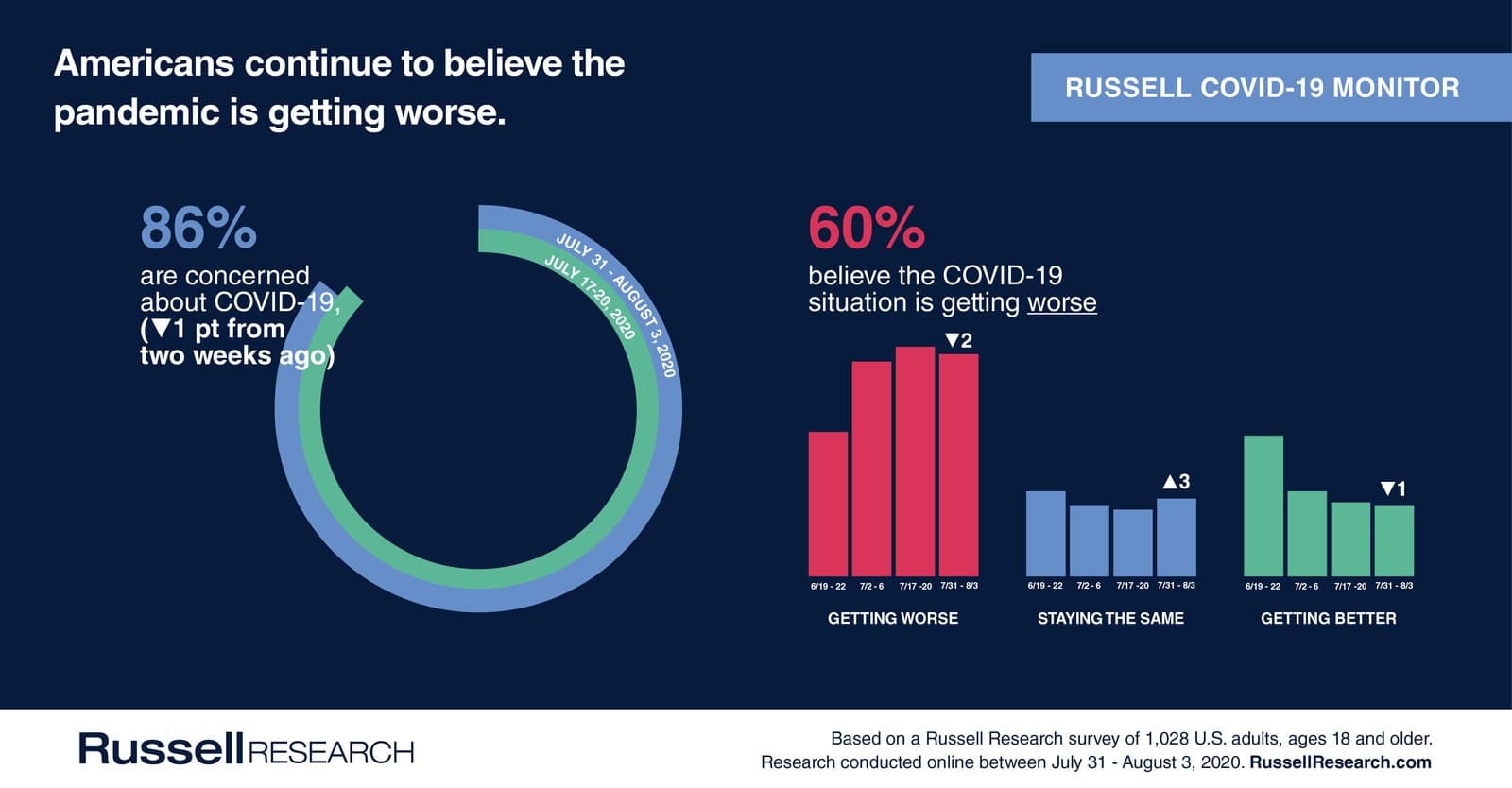

There was positive movement in the return to in-person shopping at essential item destinations, particularly dollar and grocery stores.

Essential Item Destinations

- 83% of grocery shoppers intend to shop at a grocery store in the next month (+5 percentage points vs. two weeks ago)

- 59% of category shoppers intend to shop at a mass merchandiser in the next month (no change)

- 57% of category shoppers intend to shop at a pharmacy or drug store in the next month (no change)

- 46% of category shoppers intend to shop at a warehouse store in the next month (+4)

- 46% of category shoppers intend to shop at a dollar store in the next month (+7)

Many consumers remain hesitant to dine at restaurants. Fast food continues to be the format with the most widespread consideration.

Food & Drink

- 43% of category users intend to dine at a fast food restaurant in the next month (+3 percentage points vs. two weeks ago)

- 35% of category users intend to dine at a fast casual restaurant in the next month (+2)

- 32% of category users intend to go to a coffee shop or café in the next month (+2)

- 26% of category users intend to dine at a casual dining restaurant in the next month (no change)

- 20% of category users intend to dine at a fine dining restaurant in the next month (+6)

The positive trend in visitation intent extended to specialty retailers, however aside from home improvement, the vast majority are not be ready for in-person shopping at specialty retailers.

Clothing & Specialty Retail

- 46% of category shoppers intend to shop at a home improvement store in the next month (+4 percentage points vs. two weeks ago)

- 32% of category shoppers intend to shop at a pet store in the next month (+4)

- 31% of category shoppers intend to shop at a clothing store in the next month (+6)

- 29% of category shoppers intend to shop at a department store in the next month (+2)

- 25% of category shoppers intend to shop at an auto parts store in the next month (+5)

- 25% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (+6)

- 24% of category shoppers intend to shop at an electronics store in the next month (+1)

- 22% of category shoppers intend to shop at a shoe store in the next month (+2)

- 22% of category shoppers intend to shop at a home goods store in the next month (+2)

Vaccine

Nearly three in four Americans would like to be vaccinated against COVID-19 as soon as they have the opportunity.

- 73% of Americans are very or somewhat likely to get the COVID-19 vaccine as soon as possible after FDA approval.

- 77% of males are likely to get the vaccine vs. 70% of females

- 80% of adults ages 55 and older are likely to get the vaccine vs. 71% of adults ages 18-54

- 75% of Caucasians and 76% of Hispanics are likely to get the vaccine vs. 62% of African-Americans

Most rejecters would like to take a “wait and see” approach before considering being vaccinated.

- 57% of Americans unlikely to get the COVID-19 vaccine as soon as possible indicate it is because they would want to wait to make sure it is safe.

- 45% unlikely to get the vaccine are worried the vaccines are being developed too quickly.

- 24% unlikely to get the vaccine do not trust the FDA.

- 19% unlikely to get the vaccine are generally against vaccines.