COVID-19 & Its Impact on Everyday Life: May 1 – 4, 2020

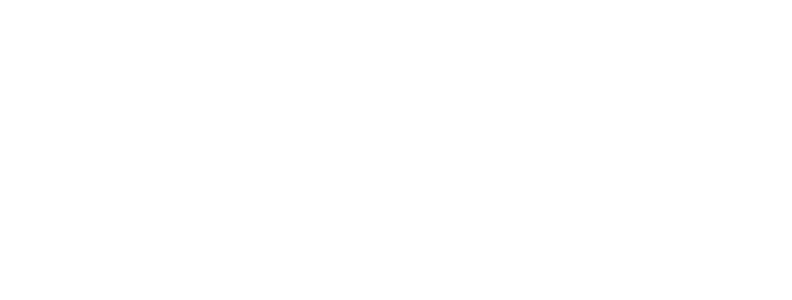

Americans are very gradually becoming more optimistic about the course of the pandemic. Concern is slowly declining. For a second consecutive week we’ve seen minor increases in the percentage who believe the situation is improving.

This is resulting in more Americans returning to essential activities. The percentage of people returning to supermarkets, larger stores, pharmacies, etc. has been mostly directional on a weekly basis. However this week’s changes are more substantial when compared to a month ago.

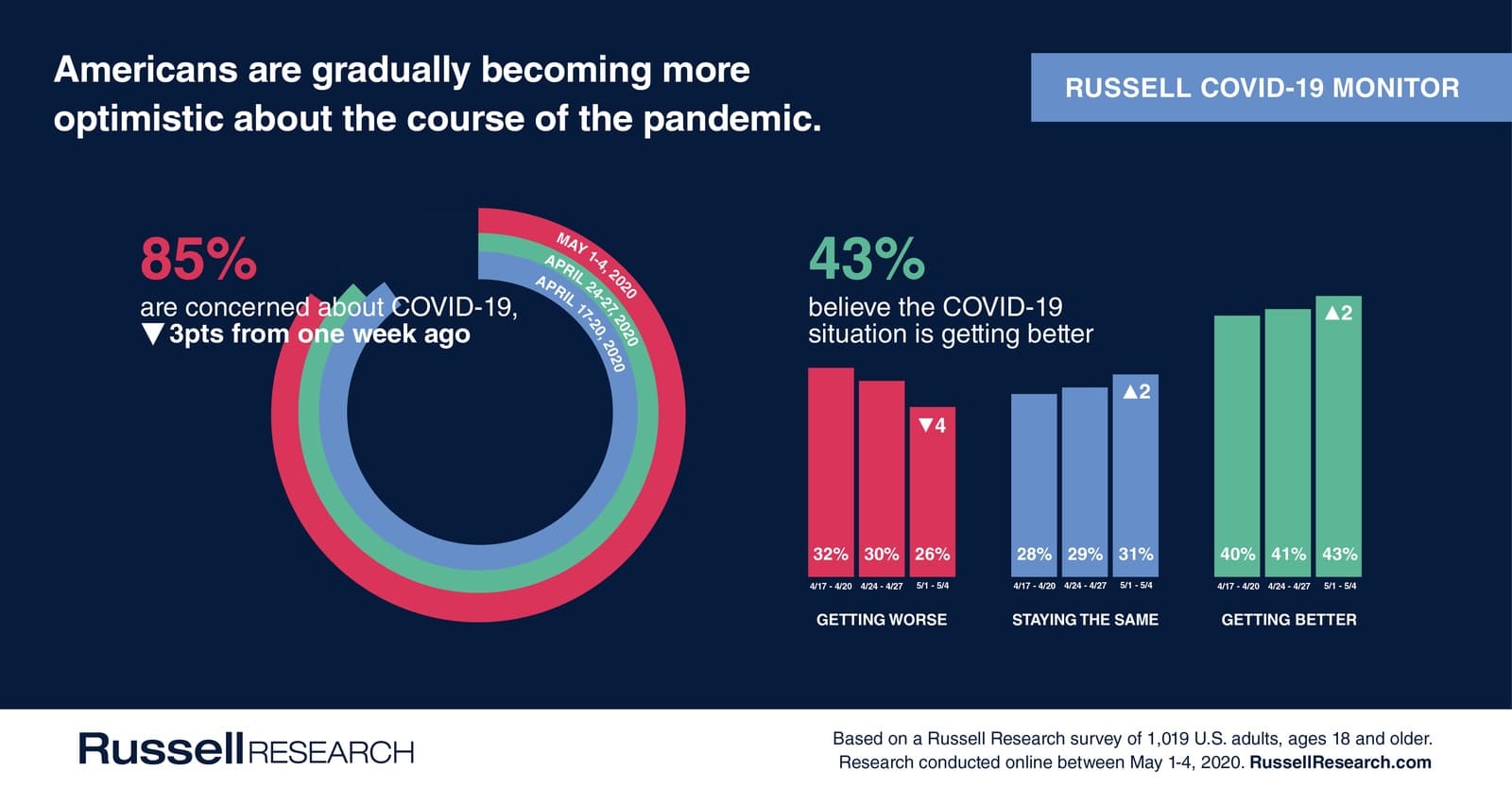

Many behavior changes initiated by COVID-19 show strong signals of continuing beyond the pandemic. Companies that have experienced growth during the pandemic (e.g., Amazon, Netflix, Peloton) and brands that can address consumer needs in these arenas look to be positioned for success in the long-term.

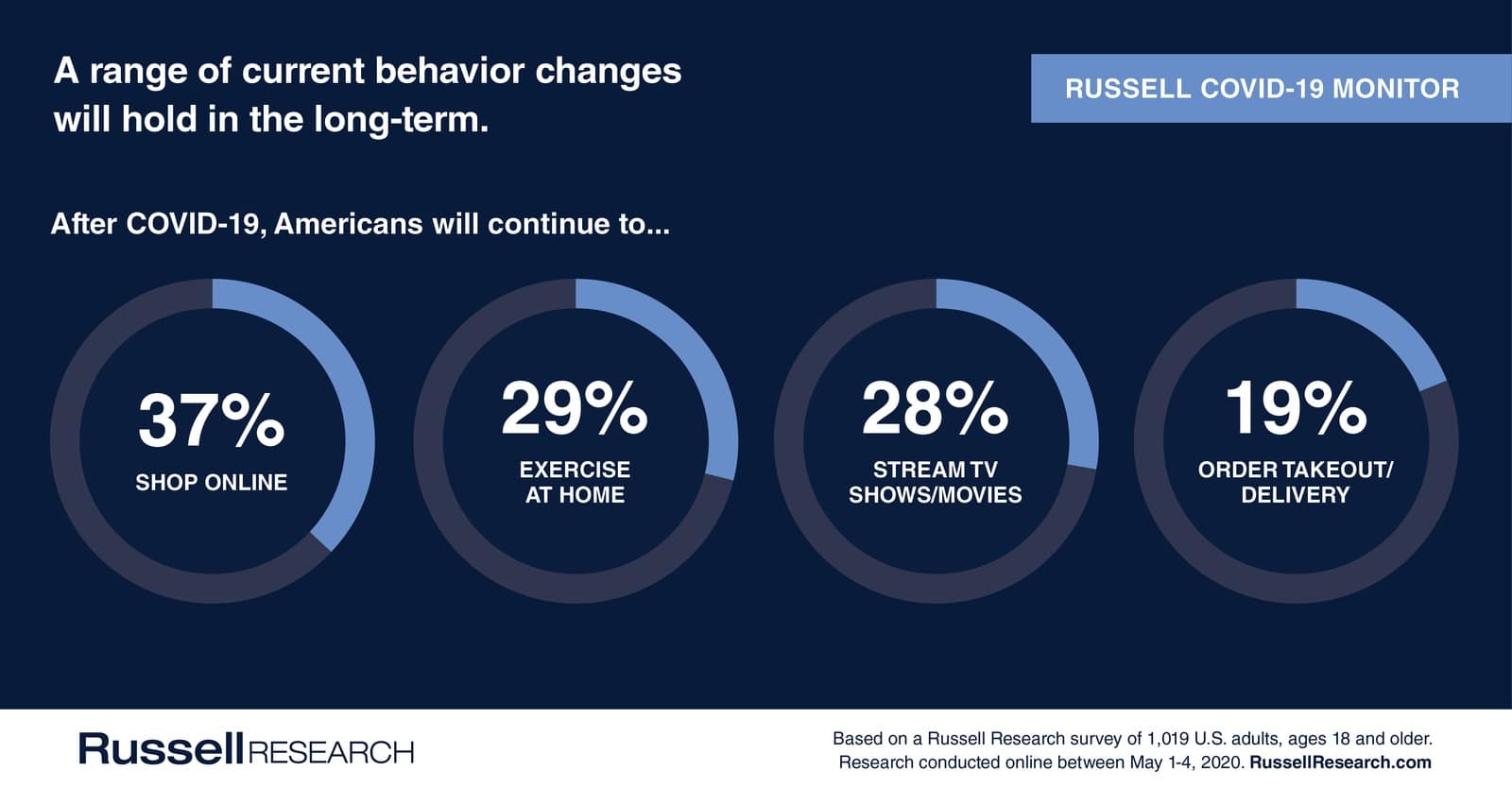

We also took another look at expectations versus desires to re-open states. Few Americans believe businesses should be allowed to resume normal operations in May and one-third believe their governor will open their state too soon. This feeling is especially prevalent in the South.

Russell Research has interviewed over 9,000 Americans over the past nine weeks about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes.

Below are our key findings from May 1-4, 2020. Russell Research has tabulated data available for all 9,000+ interviews with several additional questions asked. Please email [email protected] for more information.

Views of the Current Situation

Concern is softening among Americans. Between May 1-4, 85% of Americans indicated they are concerned about coronavirus, compared to 88% from one week prior.

- For the first time in 6 weeks, less than one-half of Americans are very concerned with COVID-19 (49%), down from 52% last week, and a high of 61% in mid-April.

More than two in five Americans believe the situation is improving. 43% of Americans feel that the current situation is getting better, compared to 41% last week. 26% believe the situation is getting worse, compared to 30% last week.

- In the Northeast, where many of the largest COVID-19 clusters are located, 48% of Northeast residents feel the situation is improving. This is the highest percentage across all census regions. Four weeks ago this proportion was only 5%.

Impact on Behavior

Americans are increasingly more open to shop in-person for essential items. Compared to four weeks ago (early April), there have been large decreases in the percentage of Americans avoiding these shopping trips.

- 44% of Americans are currently less likely to go to a large store (-5 percentage points vs. last week, -12 points vs. four weeks ago)

- 30% are currently less likely to go to the convenience store (-3 one week, -11 four weeks)

- 25% are currently less likely to go to the grocery store (-1 one week, -9 four weeks)

- 17% are currently less likely to go to a pharmacy/drug store (-3 one week, -8 four weeks)

Pandemic-induced behavior changes are still prevalent though softening.

- 60% of Americans are more likely to order online (-2)

- 39% are more likely to stock up on household items (-3)

- 46% are more likely to order takeout or delivery (-3)

- 25% are more likely to have groceries delivered (-2)

- 16% are more likely to have medication delivered (-3)

Certain behavior changes will hold for a considerable percentage of Americans post-coronavirus. This will create long-term opportunity for brands that have seen an increase in business during the pandemic.

- 37% of Americans will continue to shop online more often post-coronavirus (+2 vs. last week)

- 29% will continue to exercise at home (no change)

- 28% will continue to stream TV shows or movies (no change)

- 19% will continue to order takeout or delivery (-2)

Most Americans are still hesitant to participate in non-essential activities where social distancing is difficult. However many of these percentages are now significantly lower than from 4 weeks ago.

- 72% of Americans are less likely to go to the movies (-2 vs. last week)

- 70% are less likely to dine at a sit-down restaurant (-2)

- 67% are less likely to go to a shopping mall (-4)

- 63% are less likely to go to the gym (-4)

- 60% are less likely to go to a casino (-4)

Returning to Everyday Life

Few Americans believe businesses should be opening in the next few weeks.

- 17% of Americans believe states should allow businesses to return to normal operations in May.

- 22% believe they should be able to return to normal operations in June.

- 14% believe they should be able to return to normal operations in July.

- 16% believe they should be able to return to normal operations in August or later.

- 26% believe it’s too soon to say when businesses should be able to return to normal operations.

- 5% indicate their state has already re-opened.

One in three Americans believe their state will reopen businesses before they want them to. This concern is more widespread in the South.

- 33% of Americans believe their state will return to normal operations before they would want them to (+2 percentage points vs. last week)

- 45% believe their state will return to normal operations when they would want them to (-1)

- 23% believe their state will return to normal operations after they would want them to (no change)

- 42% of Americans in the South believe their state will return to normal operations before they would want them to, compared to 24% – 29% in other regions