COVID-19 & Its Impact on Everyday Life: July 2-6, 2020

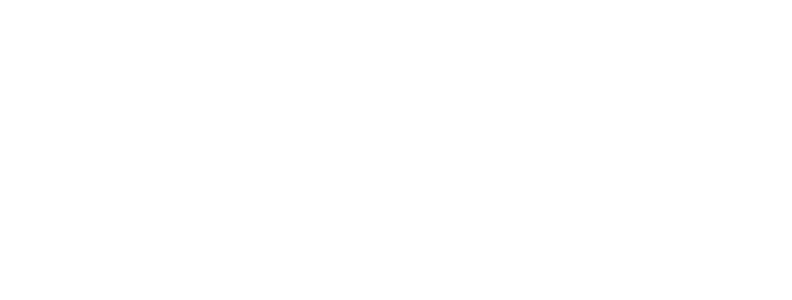

The entire trajectory of the pandemic has changed over the past four weeks. Compared to early June, more than twice as many Americans now believe the pandemic is getting worse.

The 58% of Americans who currently believe the pandemic is getting worse is a level not seen since early April. It represents a 19-percentage point increase compared to two weeks ago, and 34 points higher than four weeks ago. In comparison, 23% of Americans view the pandemic as improving, a 15-point decrease compared to two weeks ago, and 30 percentage points lower than in early June.

In our last wave of this research this negative perception was mostly contained to Americans in the South and West. It is now the predominant feeling in all regions.

84% of Americans are currently concerned about COVID-19. This is equal to findings from two weeks ago and mostly in line with findings over the past two months.

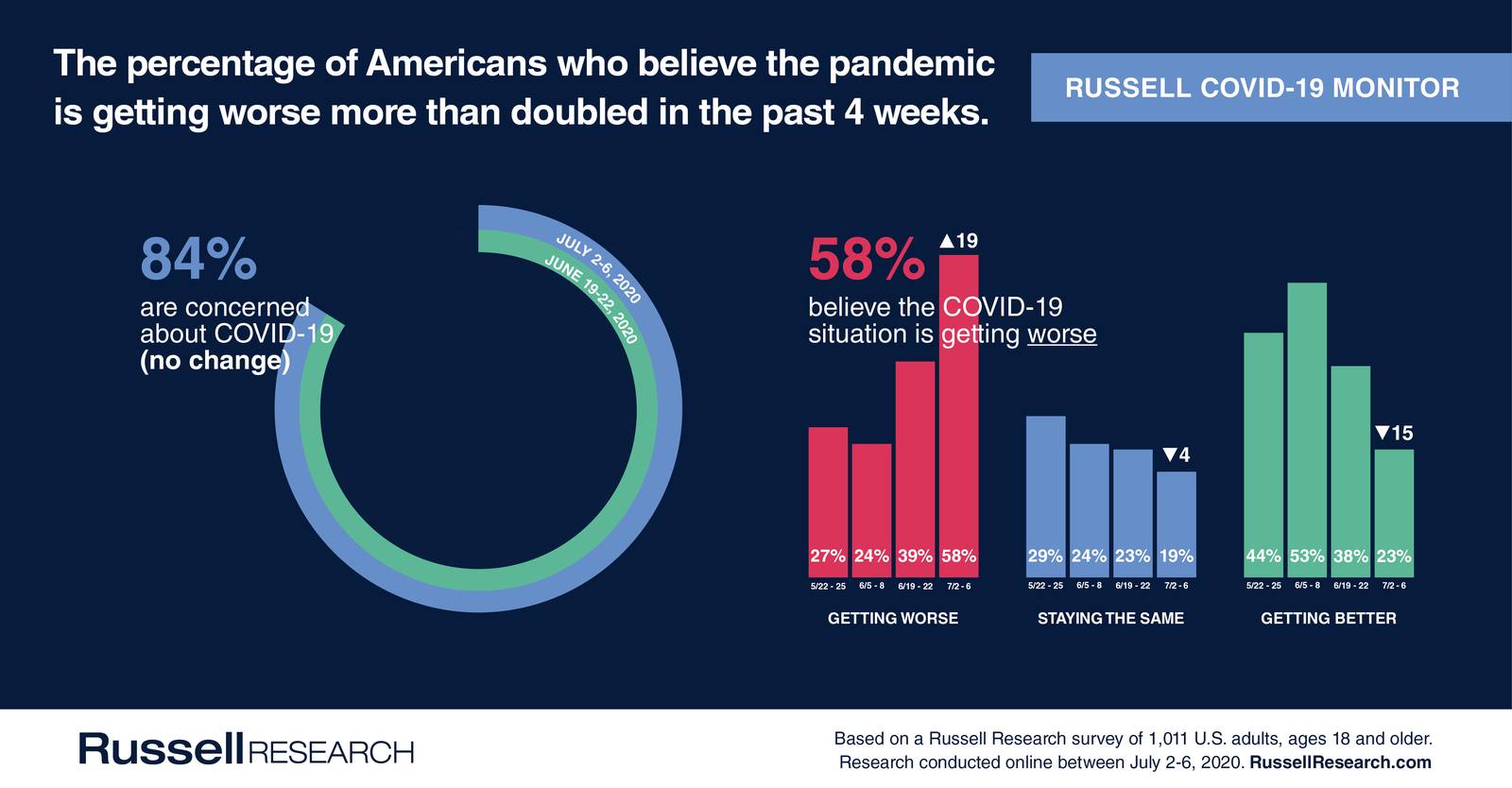

However this growing negative perception of the pandemic has slowed, but not completely stopped, the return to in-person dining and shopping. Physical shopping intent at stores which sell essential items was mostly unchanged versus two weeks ago, with a directional increase in the likelihood to shop at dollar stores. Shopping at most types of specialty retailers either held steady or experienced minor decreases in intent this week.

For restaurants, consumers are gradually more willing to return to fast food, though appear hesitant visiting formats which traditionally focus on in-person dining.

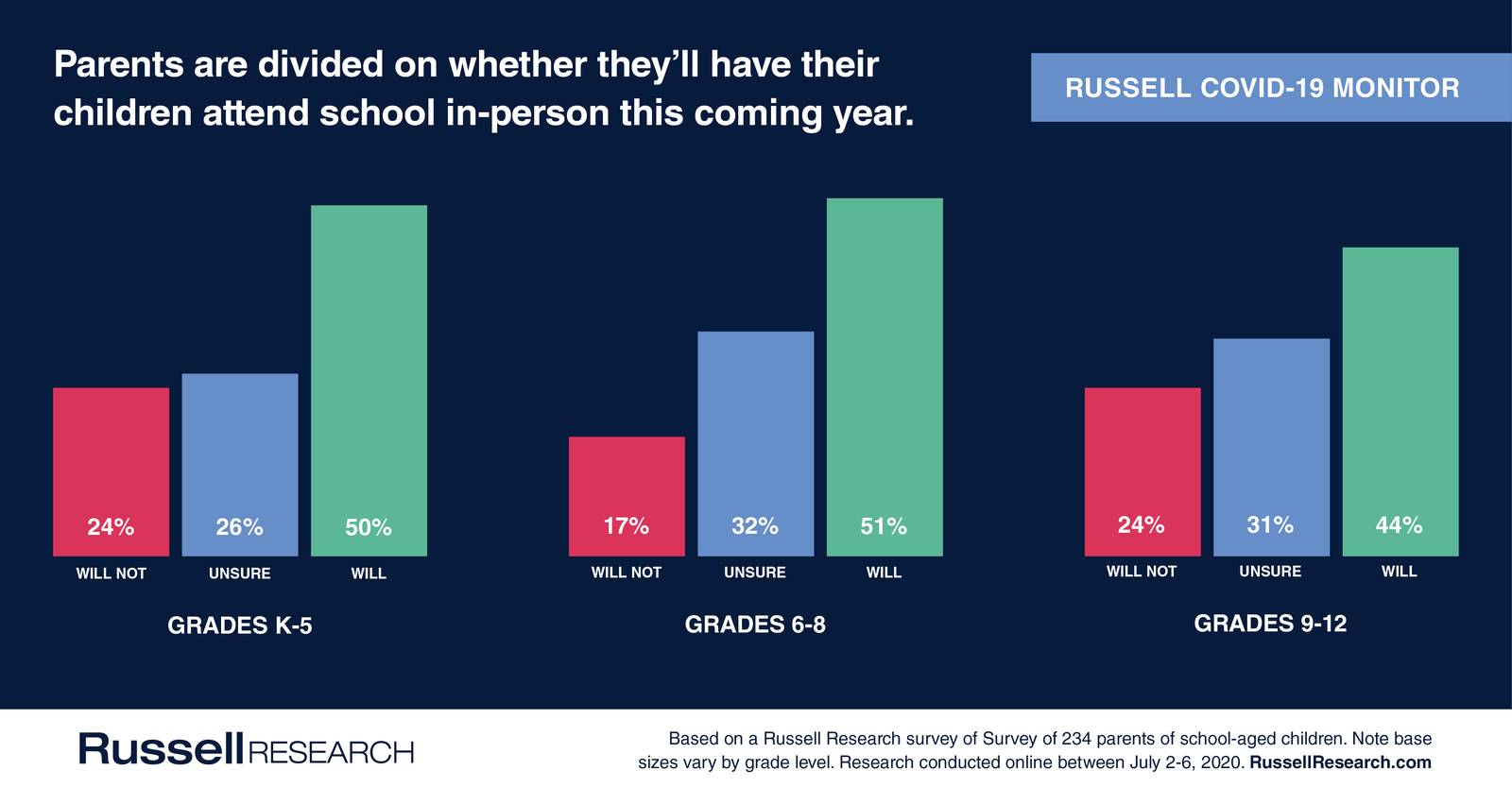

We placed a special focus this week on returning to school (K-12) and whether parents plan to have their children physically attend.

A topic of national conversation over the past week, the ability for children to safely return to school can have a cascading effect on the economy. Keeping children home would increase the reliance on and demand for technology to meet learning needs and could force parents to remain in a work-from-home environment (or out of the workforce altogether), which would impact local economic conditions.

Approximately one-half of parents are currently unsure or not willing to have their children attend school when it starts in the coming months. Their primary concerns are the ability to socially distance and the cleaning procedures which would be in place at their children’s schools.

Russell Research has interviewed over 15,000 Americans over the past 4 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes. The study currently fields every other week with the next wave slated for July 17-20, 2020.

Below are our key findings from July 2-6, 2020. Russell Research has tabulated data available for all 15,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

Concern continues to be widespread and has held steady in recent weeks. Between July 2-6, 84% of Americans indicated they are concerned about coronavirus, equal to findings from two weeks earlier.

The perceived trajectory of COVID-19 is becoming rapidly negative. 58% of Americans now believe the situation is getting worse, compared to 39% two weeks ago, and 24% four weeks ago. This is the highest percentage of Americans believing the situation is worsening since early April.

Less than one in four Americans (23%) feel that the current situation is getting better, compared to 38% two weeks ago, and 53% four weeks ago.

The negative perception of the pandemic trajectory is no longer contained to the South and West. The percentage of Northeast and Midwest residents who view it as getting worse doubled over the past 2 weeks.

- 63% of Americans in the West believe the situation is getting worse (+16 percentage points vs. 2 weeks ago, +32 vs. four weeks ago)

- 59% of Americans in the South believe the situation is getting worse (+11 vs. two weeks ago, +34 vs. four weeks ago)

- 59% of Americans in the Midwest believe the situation is getting worse (+32 vs. 2 weeks ago, +38 vs. four weeks ago)

- 50% of Americans in the Northeast believe the situation is getting worse (+25 vs. 2 weeks ago, +34 vs. four weeks ago)

Reopening America

Aside from dollar stores, where visitation intent increased directionally, there has been little change in the percentage of category shoppers who will physically enter and shop at essential item destinations over the next month.

Essential Item Destinations

- 78% of grocery shoppers intend to shop at a grocery store in the next month (+2 percentage points vs. two weeks ago)

- 67% of category shoppers intend to shop at a mass merchandiser in the next month (+3)

- 59% of category shoppers intend to shop at a pharmacy or drug store in the next month (-2)

- 51% of category shoppers intend to shop at a dollar store in the next month (+6)

- 41% of category shoppers intend to shop at a warehouse store in the next month (-2)

The current situation is pausing the return to restaurant categories which primarily focus on in-person dining. The return to fast food restaurants continues with one-half of category users now ready to visit in-person.

Food & Drink

- 50% of category users intend to dine at a fast food restaurant in the next month (+3 percentage points vs. two weeks ago)

- 35% of category users intend to dine at a fast casual restaurant in the next month (+1)

- 29% of category users intend to go to a coffee shop or café in the next month (-3)

- 26% of category users intend to dine at a casual dining restaurant in the next month (-7)

- 21% of category users intend to dine at a fine dining restaurant in the next month (-1)

Most consumers will continue to avoid in-person shopping at specialty retailers in July. Home improvement stores are the sole category where nearly one-half of consumers are willing to physically enter a store location.

Clothing & Specialty Retail

- 46% of category shoppers intend to shop at a home improvement store in the next month (+1 percentage points vs. two weeks ago)

- 34% of category shoppers intend to shop at a department store in the next month (+2)

- 31% of category shoppers intend to shop at a clothing store in the next month (-5)

- 26% of category shoppers intend to shop at a pet store in the next month (-2)

- 26% of category shoppers intend to shop at an auto parts store in the next month (+3)

- 24% of category shoppers intend to shop at an electronics store in the next month (no change)

- 23% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (-3)

- 21% of category shoppers intend to shop at a shoe store in the next month (-3)

- 20% of category shoppers intend to shop at a home goods store in the next month (-4)

Back to School

Approximately one-half of parents are either on the fence or do not intend to have their children physically attend school this coming year.

Kindergarten – 5th Grade

- 50% of parents of children entering kindergarten through 5th grade likely will have their children attend school in-person this year

- 26% might or might not have their children attend

- 24% likely will not have their children attend

6th – 8th Grade

- 51% of parents of children entering 6th through 8th grade likely will have their children attend school in-person this year

- 32% might or might not have their children attend

- 17% likely will not have their children attend

9th – 12th Grade

- 44% of parents of children entering 9th through 12th grade likely will have their children attend school in-person this year

- 31% might or might not have their children attend

- 24% likely will not have their children attend

The leading concerns associated with returning their children to school revolve around social distancing and cleaning procedures.

Social Distancing

- 52% of parents are concerned about the ability of children to socially distance from other children

- 44% of parents are concerned about the ability of children to socially distance from adults

Cleaning Procedures

- 48% of parents are concerned about cleaning procedures in the classroom

- 48% of parents are concerned about cleaning procedures in common areas around the school

Other Concerns

- 45% of parents are concerned about children being required to wear masks for several hours at a time

- 36% of parents are concerned about the school’s ability to quickly react if there is an outbreak or rise in cases

- 35% of parents are concerned about moving around the school (e.g., between classes)

- 35% of parents are concerned about activities outside of the classroom (e.g., lunch, gym, music)

- 34% of parents are concerned about the ability to teach the full curriculum