COVID-19 & Its Impact on Everyday Life: January 8-11, 2021

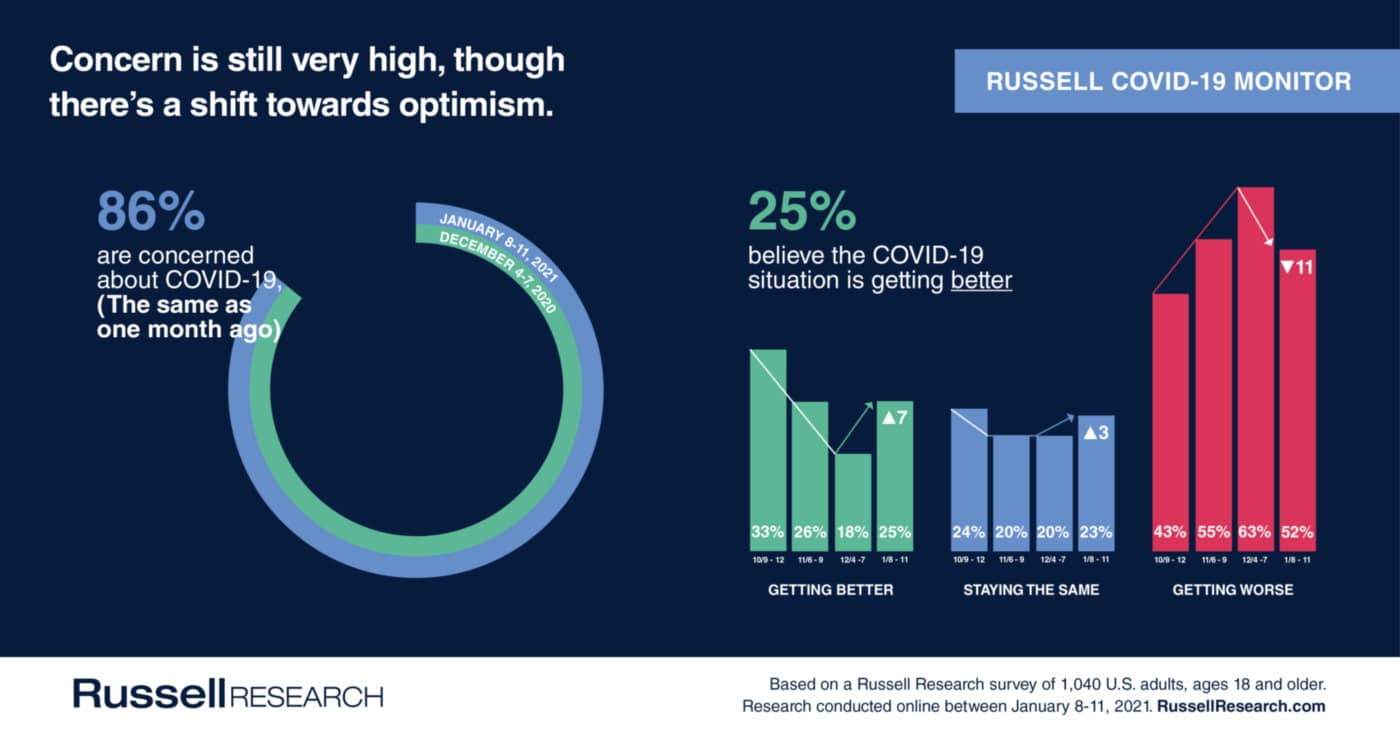

The rollout of vaccinations appears to be generating some optimism during the latest wave of the Russell COVID-19 Monitor, even as the number of COVID-19 cases continues to limit activities across the U.S.

Americans who believe the trajectory of the pandemic is getting better has grown significantly to 25%, up from 18% in early December. Concern about the pandemic remains near-universal, with 86% of Americans concerned about COVID-19.

This positive shift has driven a noticeable increase in Americans considering shopping in-person next month. This rise in shopping will extend to a variety of retail formats, including clothing stores, auto parts stores, and home goods stores.

There also appears to be a shift in Americans’ willingness to dine out in the coming weeks. People reported increases in consideration of dining at casual and fine dining restaurants.

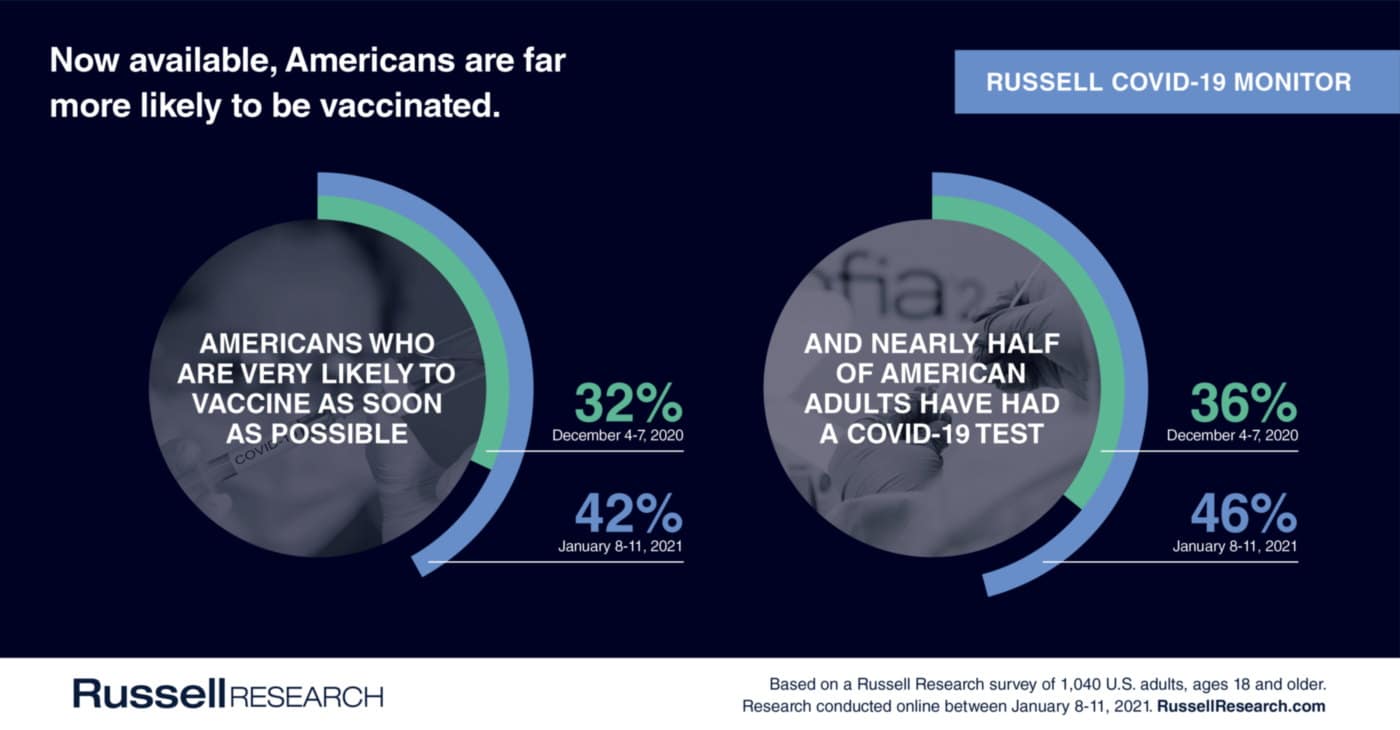

Finally, we asked about consideration for receiving the vaccine and found a significant increase to 42% of Americans indicating that they are very likely to receive the vaccine when made available to them, up from just 32% in early December.

Russell Research has interviewed more than 25,000 Americans over the past 11 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will continue to evolve in the coming waves as the situation changes. The next wave is slated for February 12 – 15, 2021.

Below are our key findings from January 8-11, 2021. Russell Research has tabulated data available for all 25,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

Concern about COVID-19 continues to be heightened. Between January 8-11, 86% of Americans indicated they are concerned about coronavirus, which remains at a noticeably higher level from the 82% indicated in September.

More importantly, nearly three-fifths of Americans (56%) are currently very concerned, the highest level recorded since mid-April, and up from 55% in December.

Conversely, with the past month rollout of the vaccine, Americans are viewing the pandemic’s trajectory more positively than they did last month. 52% of Americans currently believe that the situation is getting worse, down significantly from 63% in December.

While at the same time more than one in four Americans feel that the pandemic is getting better (25% vs. 18% in December).

COVID-19 Vaccinations

Americans are significantly more likely to get a vaccine than they were just one month prior.

- 42% of Americans indicate they are very likely to receive the COVID-19 vaccine. This is a 10-point increase from the early December result (32%).

COVID-19 Testing

Americans are also more likely to have taken a COVID-19 test.

- COVID-19 tests are on the rise as well, with 46% of the adult population indicating that they have already taken a test (up from 36% a month ago) and with 39% planning to take one/another one in the future (aligning with the 39% in early December).

Past 4-Week Activities

Activities that Americans have participated in recently are limited.

- When asked for the first time what activities they have participated in recently:

- 20% of Americans indicated having dined indoors at a restaurant within the past four weeks

- 11% have dined outdoors at a restaurant

- 8% have visited a casino

- 7% have frequented a bar

- 7% went to the movie

Impact on Behavior

Consideration for in-person shopping at essential item destinations continues to trend downward – in particular the intention to shop at mass merchandisers, dollar stores and grocery stores.

Essential Item Destinations

- 76% of grocery shoppers intend to shop at a grocery store in the next month (-3 percentage point vs. one month ago)

- 58% of category shoppers intend to shop at a pharmacy or drug store in the next month (+1)

- 63% of category shoppers intend to shop at a mass merchandiser in the next month (-4)

- 50% of category shoppers intend to shop at a convenience store in the next month (no change)

- 52% of category shoppers intend to shop at a dollar store in the next month (-3)

- 41% of category shoppers intend to shop at a warehouse store in the next month (-2)

Consumers’ willingness to visit casual and fine dining restaurant formats bounced back after decreasing sharply in December.

Food & Drink

- 45% of category users intend to dine at a fast food restaurant in the next month (-2 vs. one month ago)

- 33% of category users intend to dine at a fast casual restaurant in the next month (-1)

- 32% of category users intend to dine at a casual dining restaurant in the next month (+4)

- 31% of category users intend to go to a coffee shop or café in the next month (no change)

- 25% of category users intend to dine at a fine dining restaurant in the next month (+4)

Now that the holiday traffic has subsided, planned visitation to some brick & mortar retail formats is on the rise.

Clothing & Specialty Retail

- 44% of category shoppers intend to shop at a home improvement store in the next month (-1 vs. one month ago)

- 39% of category shoppers intend to shop at a clothing store in the next month (+4)

- 37% of category shoppers intend to shop at a department store in the next month (+1)

- 31% of category shoppers intend to shop at an auto parts store in the next month (+4)

- 30% of category shoppers intend to shop at an electronics store in the next month (no change)

- 28% of category shoppers intend to shop at a pet store in the next month (-2)

- 27% of category shoppers intend to shop at a home goods store in the next month (+5)

- 27% of category shoppers intend to shop at a shoe store in the next month (no change)

- 26% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (no change)