COVID-19 & Its Impact on Everyday Life

Over the past two weeks, Russell Research has interviewed over 2,000 Americans about their concerns with coronavirus and how it is impacting their everyday and planned behavior.

As curfews and closures impact behavior, Russell Research’s COVID-19 Monitor will evolve in the coming weeks as the situation changes.

Below are our key findings from March 13 – 16, 2020.

Views of the Current Situation

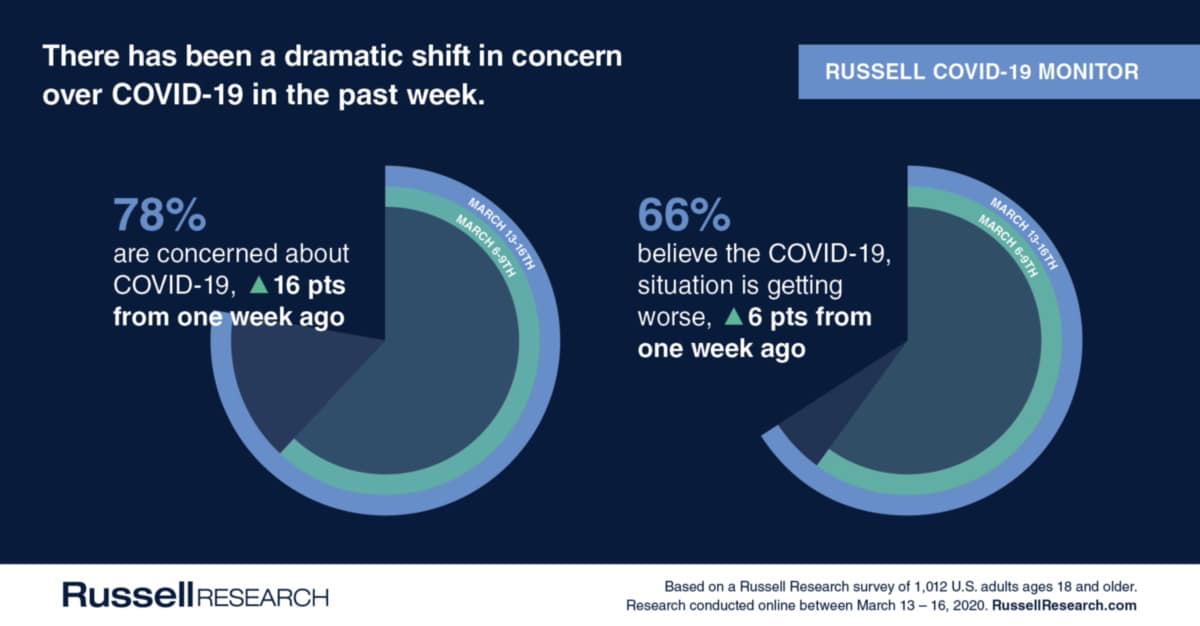

There has been a dramatic shift in concern over the past week. Between March 13-16, nearly four in five Americans (78%) indicated that they are concerned about coronavirus, a sharp increase over the 62% expressing elevated concern just one week prior (March 7-9).

The majority feel that the situation is getting worse. Two-thirds of Americans (66%) believe the current situation is getting worse, compared to 60% last week.

Impact on Behavior

Increasingly, Americans are avoiding shared/public transportation and travel.

- 56% are less likely to fly on an airplane (+11 percentage points vs. last week)

- 50% are less likely to go on vacation (+15)

- 50% are less likely to use public transportation (+17)

- 38% are less likely to stay at a hotel (+17)

- 36% are less likely to use ride-sharing services (new this week)

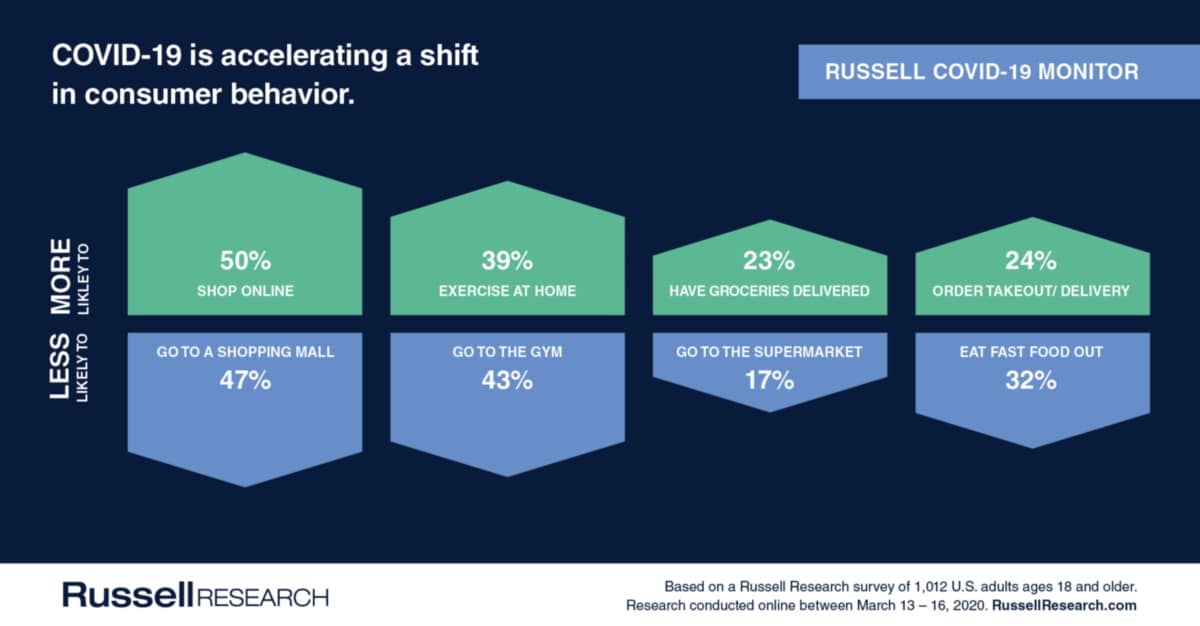

Non-essential and large crowd shopping destinations are being curtailed by American consumers, as are big-ticket purchases.

- 47% are less likely to go to a shopping mall (+23 percentage points vs. last week)

- 31% are less likely to go to a large store (+16)

- 28% are less likely to make a major or big-ticket purchase (+19)

The proportion of Americans avoiding specific entertainment and social activities have more than doubled in just a week’s time. Since fielding of this study over the weekend, an increasing number of these activities are no longer available in the short-term.

- 56% are less likely to attend a sporting event, concert, or play (+27 percentage points vs. last week)

- 50% are less likely to go to the movies (+28)

- 47% are less likely to visit a casino (+21)

- 43% are less likely to go to the gym (new this week)

- 36% are less likely to dine out at a sit-down restaurant (+22)

- 32% are less likely to dine out at a fast food restaurant (+18)

- 17% are less likely to go to the supermarket (+8)

The current pandemic is leading to behavior change among a growing proportion of Americans. The question is whether this behavior will stick after COVID-19 is no longer viewed as a concern to Americans?

- 50% are more likely to shop online (+16)

- 39% are more likely to exercise at home (new this week)

- 24% are more likely to order takeout or delivery (+10)

- 23% are more likely to have groceries delivered (new)

A small percentage of Americans are increasingly evaluating their investment strategies.

- 10% are more likely to be adjusting their investments (+2)

- 4% are more likely to be adjusting their 401K plans (unchanged)