COVID-19 & Its Impact on Everyday Life: April 17 – 20, 2020

The mood in America continues to shift to optimism. More Americans now believe the situation is improving rather than getting worse, and there were substantial decreases in reports of experiencing stress, anxiety, and sadness.

Americans are still holding their ground. They have no immediate plans to increase their exposure to society. Nearly all behavioral measures held consistent with last week, with one potential sign of consumer optimism – a decrease in the percentage of households who are stocking up on items.

We placed a focus this week on resuming pre-pandemic activities. There is no consensus. A considerable percentage of Americans plan to eat out, go to the movies, and shop immediately. A larger group will have a “wait and see” approach. There are some who will wait until there is better treatment and/or a vaccine.

Americans are also divided on their individual state’s plans to open business back up for activity. Three in ten Americans think their state will open too early – including more than four in ten in the South.

Russell Research has interviewed over 7,000 Americans over the past seven weeks about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes.

Below are our key findings from April 17-20, 2020. Russell Research has tabulated data available for all 7,000+ interviews with several additional questions asked. Please email [email protected] for more information.

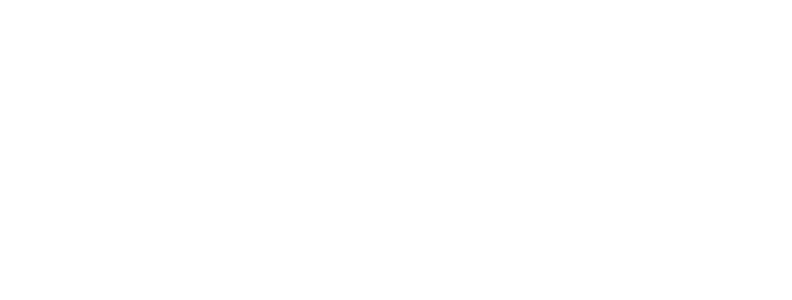

Views of the Current Situation

Concern remains near universal. Between April 17-20, nine in ten Americans (90%) indicated they are concerned about coronavirus, compared to 92% from one week prior.

Americans increasingly believe the worst is behind us. 40% of Americans believe the current situation is getting better, compared to 30% last week, and 10% two weeks ago. There has also been a dramatic decrease in the percentage of Americans who believe the situation is getting worse, from 47% last week to 32% this week.

Emotion

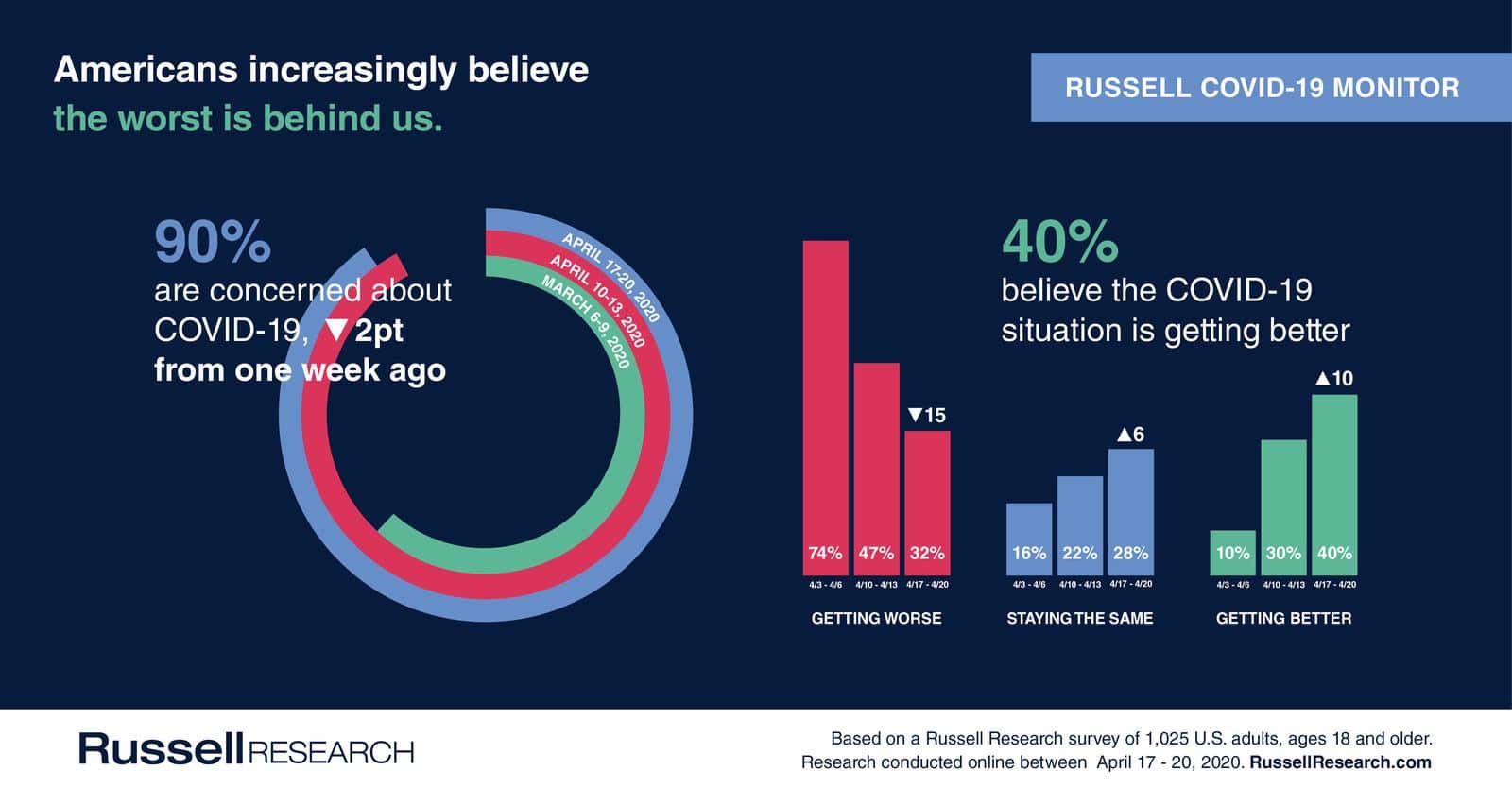

Negative emotions also continue to subside – particularly stress. However this is not being replaced by positive feelings.

- The most widely reported negative emotions are becoming less common among Americans.

- Overall, 82% of Americans experienced 1 or more negative emotions in the past week (-4 percentage points vs. last week)

- 38% of Americans were cautious during the past week (-1)

- 35% experienced stress during the past week (-9)

- 34% felt uncertain during the past week (-4)

- 33% were anxious during the past week (-7)

- 31% were frustrated during the past week (-3)

- 20% were sad during the past week (-6)

- Positive emotions continue to be less common though are increasing.

- Overall, 61% of Americans experienced 1 or more positive emotions in the past week (+3 percentage points vs. last week)

- 33% of Americans were thankful during the past week (-5)

- 21% were optimistic during the past week (+4)

- 19% felt responsible during the past week (+2)

- 15% felt satisfied during the past week (+5)

Impact on Behavior

Most Americans are holding tight with current behavior. There was a notable decline in stocking up on household items, perhaps aligning with their increased optimism.

- 56% of Americans are less likely to go to a large store (no change vs. last week)

- 41% are less likely to go to the convenience store (+1)

- 34% are less likely to go to the grocery store (+1)

- 26% are less likely to go to a pharmacy/drug store (+3)

- 63% of Americans are more likely to order online (+1)

- 45% are more likely to stock up on household items (-5)

- 49% are more likely to order takeout or delivery (+1)

- 33% are more likely to have groceries delivered (-2)

- 22% are more likely to have medication delivered (no change)

Returning to Everyday Life

Most Americans will use a “wait and see” approach in terms of resuming many pre-coronavirus activities. However a considerably sized cohort will return as soon as it’s possible, with reduced capacity a requirement for some.

Shopping Malls

- 34% of shoppers will return to shopping malls as soon as they open/resume business

- 9% will only immediately return provided capacity is reduced

- 25% plan to return 1-3 months after they open

- 18% plan to wait more than 3 months after they open

- 13% will only go after a proven treatment has been found for the coronavirus

- 10% will only go after a vaccine is available to prevent coronavirus

Sit-Down Restaurants

- 41% of restaurant diners will dine at sit-down restaurants as soon as they open/resume business

- 13% will only immediately return provided capacity is reduced

- 29% plan to return 1-3 months after they open

- 11% plan to wait more than 3 months after they open

- 9% will only go after a proven treatment has been found for the coronavirus

- 9% will only go after a vaccine is available to prevent coronavirus

- 1% will likely never go again

Fast Food Restaurants

- 43% of fast food visitors will dine at fast food restaurants as soon as they open/resume business

- 11% will only immediately return provided capacity is reduced

- 25% plan to return 1-3 months after they open

- 12% plan to wait more than 3 months after they open

- 8% will only go after a proven treatment has been found for the coronavirus

- 11% will only go after a vaccine is available to prevent coronavirus

Movie Theaters

- 29% of moviegoers will return to movie theaters as soon as they open/resume business

- 10% will only immediately return provided capacity is reduced

- 25% plan to return 1-3 months after they open

- 17% plan to wait more than 3 months after they open

- 15% will only go after a proven treatment has been found for the coronavirus

- 12% will only go after a vaccine is available to prevent coronavirus

- 2% will likely never go again

Airlines

- 28% of air travelers will resume flying as soon as they resume business

- 6% will only immediately fly again provided capacity is reduced

- 19% plan to fly again 1-3 months after they resume business

- 18% plan to wait more than 3 months after they resume business

- 15% will only fly again after a proven treatment has been found for the coronavirus

- 16% will only fly again after a vaccine is available to prevent coronavirus

- 3% will likely never fly again

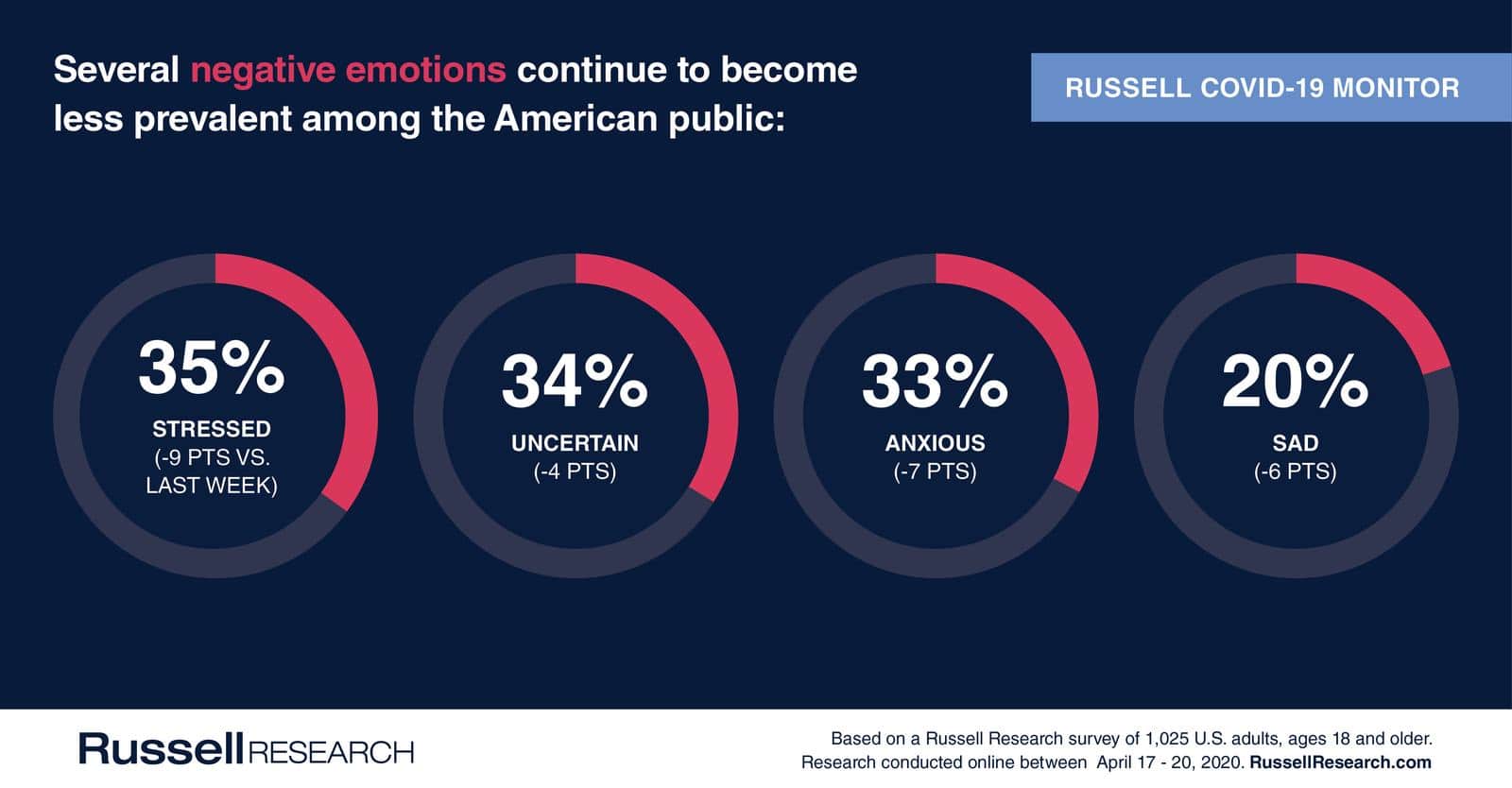

Perceptions of The Timing To Reopen Businesses

Americans are divided on the perceived timing when they believe their state will reopen businesses. Concern is strongest in the South.

- 30% of Americans believe their state will return to normal operations before they would want them to

- 44% believe their state will return to normal operations when they would want them to

- 26% believe their state will return to normal operations after they would want them to

- 42% of Americans in the South believe their state will return to normal operations before they would want them to, compared to 21% – 25% in other regions

There is no consensus of when America should re-open.

- 33% of Americans believe their state should return to normal operations by the end of May

- 19% believe their state should return to normal operations in June

- 18% believe their state should return to normal operations in July or later

- 30% believe it’s too soon to say